SERVER ERROR!

404 – File or directory not found.

The resource you are looking for might have been removed, had its name changed, or is temporarily unavailable.

The resource you are looking for might have been removed, had its name changed, or is temporarily unavailable.

Jul 9, 2019

In 2009, Dr. James Lusk developed a state-of-the-art ophthalmic surgery center open to local ophthalmic surgeons and devoted to providing a cost-effective alternative to the hospital settings. Eleven regional ophthalmic surgeons currently work at the center.

Jul 9, 2019

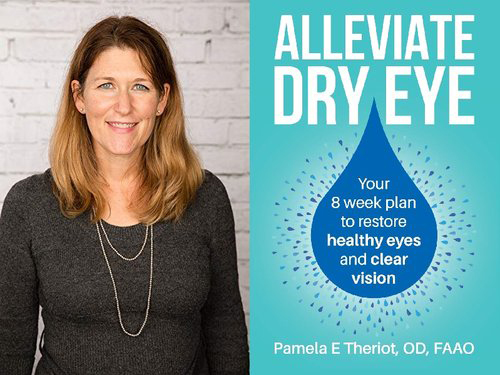

Over her years of practicing in many different climates, Dr. Theriot has treated hundreds of patients with dry eye symptoms. Oftentimes these patients have seen practitioner after practitioner with no resolution. They have usually been given a handful of over-the-counter drops, but never a plan on how to relieve their tired, dry eyes. Now patients locally and around the world can learn from her book: Alleviate Dry Eye: Your 8 week plan to restore healthy eyes and clear vision.

Jul 10, 2019

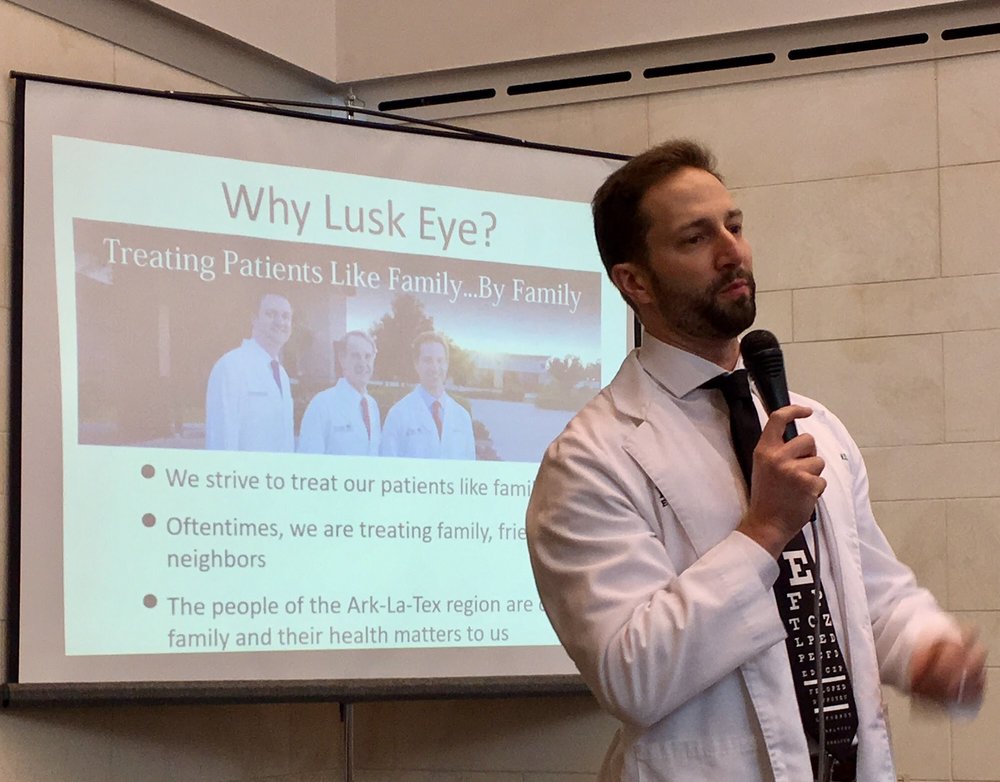

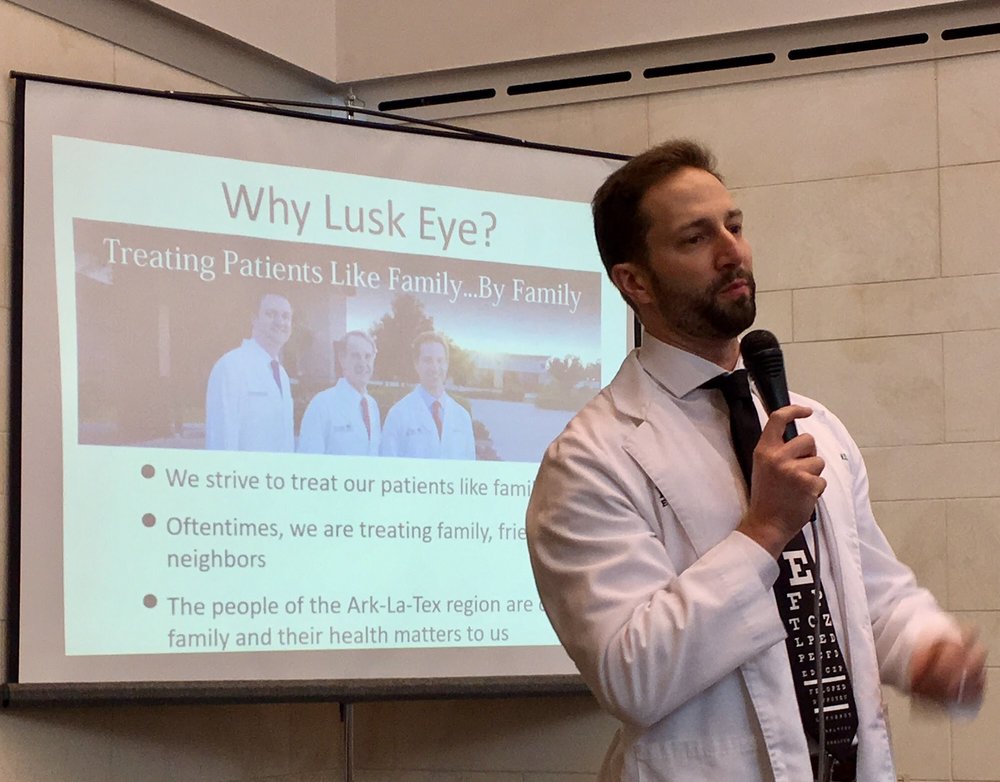

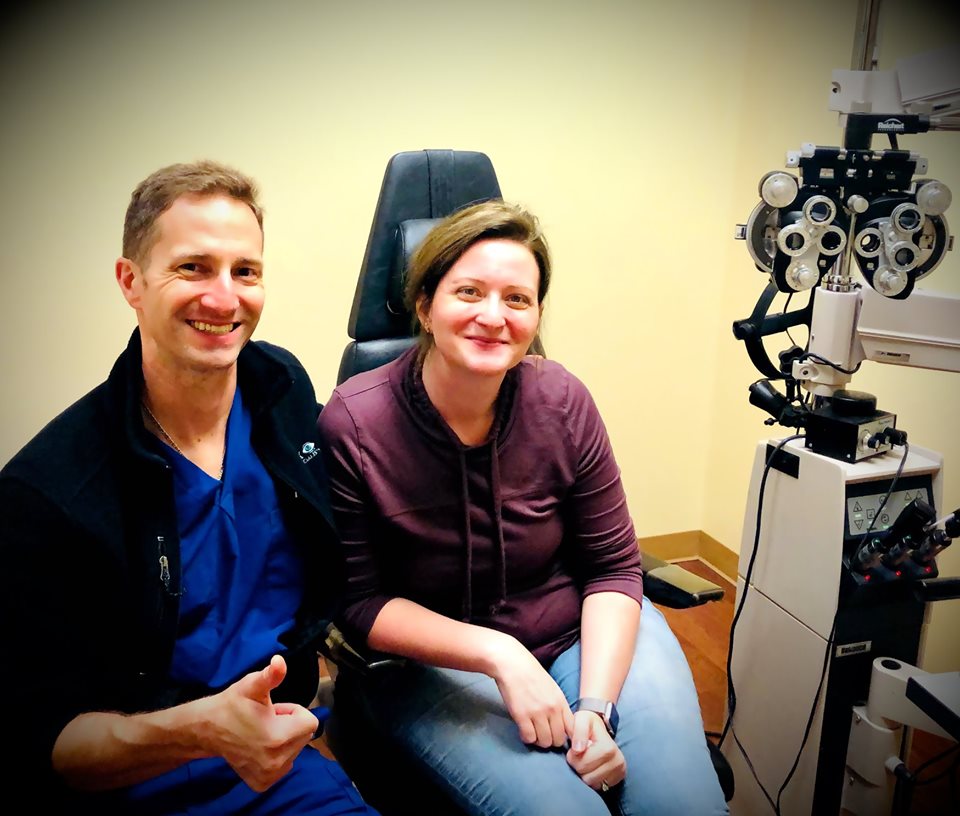

Dr. Bryan Lusk’s faith, commitment to treat each patient like his own family member, and excellent interpersonal communication skills are reflected in his well-liked bedside manner, locally and on medical mission trips.

Jun 23, 2019

Request an Appointment

Dr. Bryan Lusk’s dedication to best patient care keeps him constantly bringing the best outcomes in eye care from around the world back to his hometown.

Jun 23, 2019

Dr. Bryan Lusk’s dedication to best patient care keeps him constantly bringing the best outcomes in eye care from around the world back to his hometown.

Jun 23, 2019

Dr. Jeffrey Lusk is on the forefront of an exciting time as a glaucoma specialist, as new minimally invasive glaucoma surgeries have become available. These surgical options often provide patients with safer procedures to get better control of this difficult disease process.

Jul 9, 2019

A recent passion shared by the Lusk family of both staff and surgeons has been in medical mission work in Montemorelos, Mexico. In 8 self-funded trips with 5-7 staff over the last 10 years, Lusk Eye Specialists teams have participated in over 5,000 cataract procedures for marginalized people from all over Mexico. The trips are a win-win; as we give vision to severely disabled locals, we take on some of the world’s most challenging, late-stage cases and hone our surgical skills at the same time.

Jun 26, 2019

Jun 9, 2019

Jun 26, 2019

Jun 29, 2019

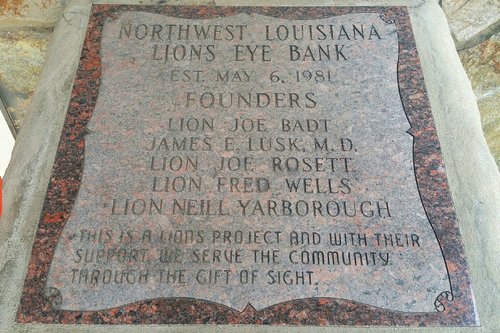

The eye bank provides the Ark-La-Tex with tissue for corneal transplants and eye treatments. Dr. James Lusk served as medical director of the eye bank for decades and now his son Dr. Bryan carries on that role.

Aug 9, 2019

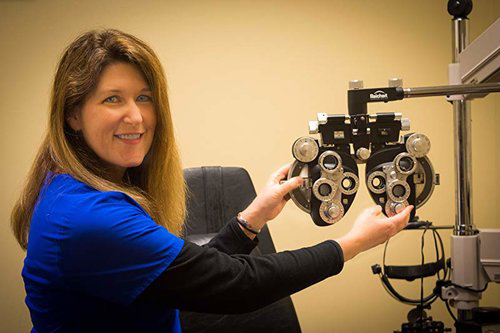

Dr. Susan Donald is the Founder and Director of the Scleral Lens Center at Lusk Eye Specialists. She is a licensed Therapeutic Optometrist in the states of Texas and Louisiana.

Jul 11, 2019

Dr. Jeffrey Lusk has a focus on achieving fantastic visual outcomes with both CustomVue LASIK and premium cataract surgery.

Jun 26, 2019

Why do we partner in this Mexico mission? Here’s one reason:

This 21 year old developed cataracts at an unusually young age. She was so excited to be able to see her children.

Jun 26, 2019

Jul 15, 2019

Dr. Bryan Lusk answers the question: Can LASIK and cataract surgery prolong your life, or the lives of your loved ones?

Jun 23, 2019

Jul 29, 2019

Dr. Walker has been happily married to his wife, Sadie, for nearly 50 years, and they have two sons and three grandchildren.

Jul 15, 2019

Jul 29, 2019

Besides being one of the few physicians in the world skilled in the advanced DMEK procedure, invited to lecture and train MDs and PhDs in locales such as Washington, D.C. and China, Dr. Bryan Lusk is the first physician in North Louisiana to provide Visian Toric ICL to patients whose myopic prescriptions and astigmatism are too high for LASIK.

Jun 23, 2019

Dr. Donald and her husband raise an assortment of animals on a small farm and enjoy aviation. Dr. Donald is a student pilot, and her husband is a Certified Flight Instructor.

Jul 16, 2019

When she isn’t working in the office, Dr. Theriot likes to run, swim, camp, and spend time with family.

Jul 10, 2019

Dr. Branton and his family enjoy traveling to the rugged Maine coastline. Rather than lobster, they enjoy fish such as salmon and haddock!

Jul 29, 2019

Not a candidate for LASIK because your prescription and astigmatism are too high? Trust in Dr. Bryan Lusk—1st Visian Toric ICL in North Louisiana and top LASIK Alternatives.

Jun 23, 2019

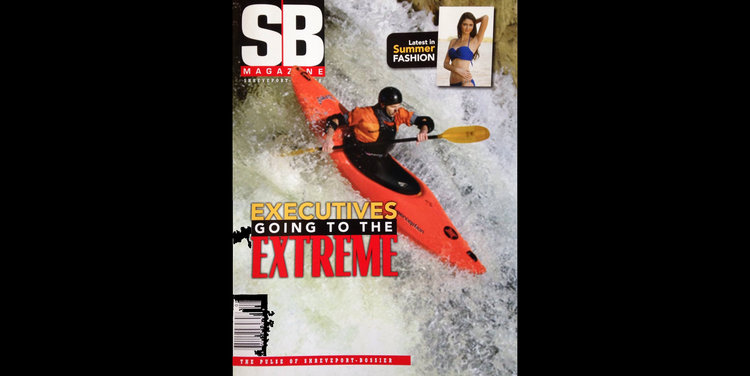

Dr. Bryan Lusk and his wife, Stephanie Yu Lusk (director of the Marlene Yu Museum and Rainforest Art Foundation), have two children. They enjoy a variety of outdoor sports, notably competitive whitewater kayaking and snowboarding, and experiencing diverse cultures.

Jun 24, 2019

Jul 10, 2019

All of the doctors and staff at Lusk Eye Specialists, not just Dr. James Lusk’s sons, are inspired by his passion to treat each patient “like a member of your own family” and to do so with the most proven and advanced technology available.

Jul 8, 2019

Dr. Walker has helped thousands of people over the years achieve their best sight, while also building lasting relationships with his patients. His family-oriented, caring nature makes his practice a good fit at Lusk Eye Specialists.

Jul 15, 2019

Dr. Donald participated in a rapid fire case discussion on fitting irregular cornea at the 2019 Global Specialty Lens Symposium in Las Vegas.

Jul 11, 2019

Dr. Theriot joined the Lusk Eye Specialists family from Tucson, AZ where she developed her love of treating patients suffering from dry eye symptoms.

Jul 10, 2019

Learn more about Dr. T and her thoughts on dry eye disease at her website: www.pamtheriot.com.

Jul 10, 2019

Dr. Branton enjoys various outdoor activities, but his favorite outdoor hobby is golf.

Jul 29, 2019

Dr. Walker spends his evenings preparing lessons for Sunday school classes. On his days off, he is in Baton Rouge spending time with his grandchildren or in Shreveport teaching children and young adults about Christ.

Jul 15, 2019

Jul 29, 2019

Dr. Susan Donald was an assistant professor before relocating to the Ark-La-Tex with her husband, a native East Texan.

Jul 16, 2019

Dr. Branton invited Dr. James Lusk to speak at an event, and afterwards began to practice with him in 1983. Dr. Branton joined Lusk Eye Specialists in 1994.

Jul 29, 2019

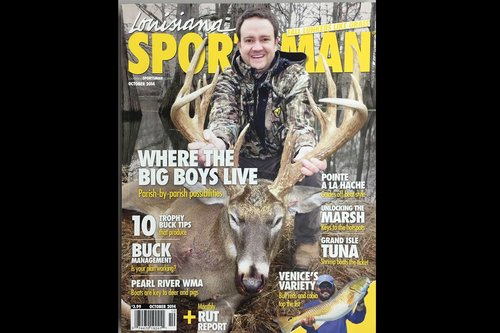

On his off days, Dr. Jeffrey Lusk enjoys hunting and spending time with his family.

Jul 11, 2019

Dr. Susan Donald’s areas of expertise include fitting scleral lenses for patients with keratoconus, irregular corneas, high nearsightedness, farsightedness, and astigmatism.

Jul 30, 2019

Dr. Walker has been a leader in eye care for the Ark-La-Tex for over 40 years. In 2016, Dr. Walker moved his practice from Eyes and Eyewear on Pines Road to Lusk Eye Specialists where his patients have continued to receive quality care, have access to state-of-the-art equipment, and have the ability to be seen by three of the finest eye surgeons when needed.

Jul 15, 2019

Dr. Theriot is a consultant to several pharmaceutical companies and has lectured at optometric events in New Mexico, Arizona, New York, and Louisiana.

Jul 10, 2019

Dr. Branton and his wife Pat enjoy spending time with their son, Jon Jr., their daughter-in-law, Christie, and their two grandchildren, Kambrie and Easton.

Jul 29, 2019

Prior to joining Lusk Eye Specialists, Dr. Branton was in private practice from 1982-1993 where he was instrumental in establishing the first hospital-based Low Vision Clinic in Louisiana. He also trained residents in low vision. His early career included grand rounds at both Tulane and LSU Medical Schools in New Orleans.

Jul 29, 2019

Dr. Theriot, her Air Force husband, Gregory, and their two daughters, Emma and Alexandra enjoy living in Benton, Louisiana, and spending time with their extended family in South Louisiana.

Jul 10, 2019